Earn a 7% Yield with a Preferred Stock

Own a Piece of the

Harmon Comeback Story

Earn a 7% Yield with a Preferred Stock. There is nothing like Harmon that exists in the retail world. Moreover, Harmon is not only about just shopping but it’s about treating yourself and about the treasure hunt. Harmon has already re-achieved millions of dollars in sales in only 12 months since reopening across only a handful of stores. Now is your chance to invest as we roll out additional store openings, expand further online, and roll out new areas of focus.

$1.00

Unit Price

$2,500

Min. Investment

CORPORATE PRESENTATION

Investors can use their credit cards, ACH, WIRE or Check to invest now. The definition of an individual accredited investor under the Securities Act of 1933, Rule 501(a)[1] is that you have (i) gross individual income of $200,000 – or $300,000 with your spouse if filing jointly – in both of the previous 2 years with a reasonable expectation that you will attain that level of income in the current year, or; (ii) individual net worth (excluding primary residence) – or joint net worth with a spouse – in excess of $1,000,000. You may wish to visit the SEC website to learn more, and view their Accredited Investor Information1. Note that income verification is valid for 12 months from the date we confirm it, while net worth verification is only valid for 3 months from the date we confirm it. Unverified investors will not be permitted to participate in this Offering.

Subscription Agreement - Individual

Subscription Agreement - Entity

Own a Piece of the

Harmon Comeback Story

Earn a 7% Yield with a Preferred Stock. There is nothing like Harmon that exists in the retail world. Moreover, Harmon is not only about just shopping but it’s about treating yourself and about the treasure hunt. Harmon has already re-achieved millions of dollars in sales in only 12 months since reopening across only a handful of stores. Now is your chance to invest as we roll out additional store openings, expand further online, and roll out new areas of focus.

$1.00

Unit Price

$2,500

Min. Investment

Investors can use their credit cards, ACH, WIRE or Check to invest now. The definition of an individual accredited investor under the Securities Act of 1933, Rule 501(a)[1] is that you have (i) gross individual income of $200,000 – or $300,000 with your spouse if filing jointly – in both of the previous 2 years with a reasonable expectation that you will attain that level of income in the current year, or; (ii) individual net worth (excluding primary residence) – or joint net worth with a spouse – in excess of $1,000,000. You may wish to visit the SEC website to learn more, and view their Accredited Investor Information1. Note that income verification is valid for 12 months from the date we confirm it, while net worth verification is only valid for 3 months from the date we confirm it. Unverified investors will not be permitted to participate in this Offering.

Why Harmon?

Harmon is not just another beauty store - it’s a movement.

For over 50 years, Harmon was a go-to destination for health, beauty, and everyday essentials across New York and New Jersey. When Bed Bath & Beyond folded, Harmon didn’t fail, the parent company did. At the time, Harmon was thriving with $150M+ in annual sales and plans for national expansion.

Now, it's back. Revived by a new owner and core members of the original team, Harmon has relaunched brick-and-mortar stores, rebooted its eCommerce presence, and introduced a membership program—all generating over $5 million in revenue in just 12 months.

INVEST NOW

“I’ve been a loyal customer of Harmon stores in New Jersey for about 30 years….clean, well-organized and the most helpful staff!”

What Makes Harmon Special?

Legacy + Loyalty

Harmon has multi-generational brand equity, especially in the NY/NJ metro area.

Impulse Magic

Customers famously dubbed it “Hundred Dollar Harmon” because you never left empty-handed.

Curation > Chaos

It’s the rare store where value, discovery, and joy intersect.

Category Breadth

From travel-size favorites to skincare, salon-grade beauty, and more, Harmon is a one-stop shop.

INVEST NOW

The Business Model

1

Core revenue from retail sales (online and in-store)

2

Growing paid membership program for loyalty and perks

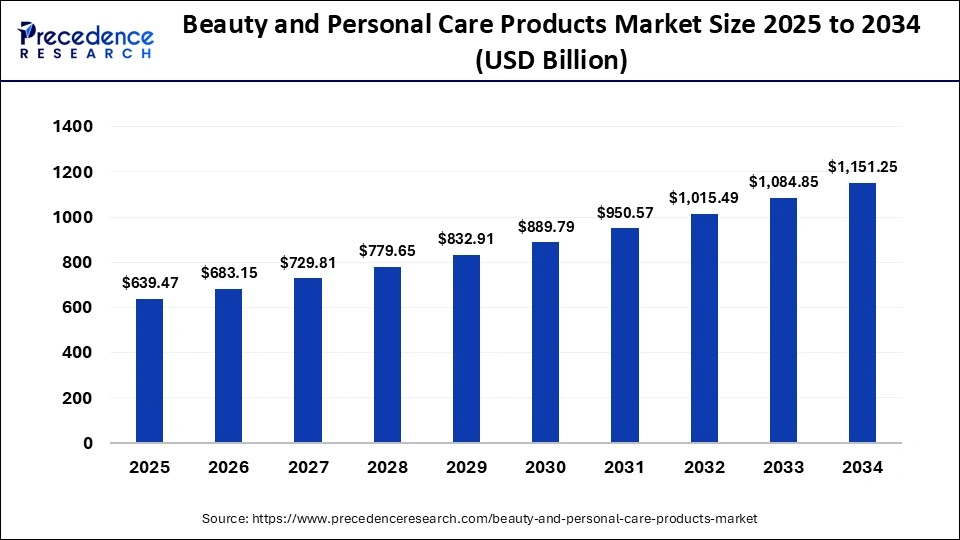

The Market Opportunity

Harmon sits at the sweet spot of two booming sectors:

1. Off-Price Retail: Consumers crave brand names without premium price tags. Beauty / Cosmetics is the fastest-growing segment in this space.

2. Beauty & Personal Care: A global market projected to surpass $1 trillion by 2030.

INVEST NOW

S&P data shows off-price and beauty retailers have consistently outperformed retail peers. Harmon is uniquely positioned to ride both waves.

Investor Perks

Get investor perks for a limited time, including a 7% Yield with a Preferred Stock.

INVEST NOW

📡 $2,500 – $5,000: Insider Circle

→ Free 1 year VIP Membership (2% back + exclusive offers + Free Welcome Gift + Free Birthday Gift)

→ $50 Harmon Gift Card

📡 $5,001 – $10,000: Founders Circle

→ Free 2 year VIP Membership (2% back + exclusive offers + Free Welcome Gift + Free Birthday Gift)

→ $100 Harmon Gift Card

→ Exclusive first access of all new product launches of our “Face Values” line.

🛍️ $10,001 – $30,000: Retail Revolution Partner

→ Free 3 year VIP Membership (2% back + exclusive offers + Free Welcome Gift + Free Birthday Gift)

→ $150 Harmon Gift Card

→ Exclusive tester of all new product launches of our “Face Values” line

→ Limited-Edition Harmon Beauty Box (curated quarterly for 1 year)

🏬 $30,001 – $50,000: Expansion Circle

→ Free 5 year VIP Membership (2% back + exclusive offers + Free Welcome Gift + Free Birthday Gift)

→ $150 Harmon Gift Card

→ Exclusive tester of all new product launches of our “Face Values” line

→ Limited-Edition Harmon Beauty Box (curated quarterly for 1 year)

→ Annual Investor Update Newsletter (exclusive behind-the-scenes updates)

💎 $50,000+: Harmon Visionary

→ Free 5 year VIP Membership (2% back + exclusive offers + Free Welcome Gift + Free Birthday Gift)

→ $150 Harmon Gift Card

→ Exclusive tester of all new product launches of our “Face Values” line

→ Limited-Edition Harmon Beauty Box (curated quarterly for 1 year)

→ Annual Investor Update Newsletter (exclusive behind-the-scenes updates)

→ Store-opening ribbon-cutting invitation with the team

→ Priority access to future investment rounds

🤝 $100,000+: Strategics

→ Contact info@harmondiscount.com.

The Team

Jonah Raskas

CEO/Owner

Jonah Raskas started his career working in The White House where he worked under George W. Bush in his speech writing office. Following his...

time in Washington D.C. Jonah spent time working in Investment Banking helping companies raise capital via public public offerings (IPOs, Secondaries, etc.) or private offerings.

Jonah has also spent a number of years as an operator where he managed business lines such as Advil, Excedrin, Voltaren, Paradontax, Poligrip and Polident for GSK Consumer Healthcare (now Haleon on NYSE).

Most recently, Jonah's focus has been utilizing his unique combination of banking and operational experience to help transform or acquire companies.

Jonah led the go public transaction with Wag! (Nasdaq: PET) and is currently a board advisor to that public company.

Wag! is one of the leading pet marketplaces that offers pet parents a wide range of offerings such as dog walking, boarding, sitting, 24/7 vet chats, home visits, training, and pet insurance comparison tools.

David Eckert

Merchandising/Inventory Lead

David Eckert with over three decades of experience in senior leadership roles within the retail sector David brings a profound understanding of the...

industry to the re-launch of Harmon Stores. Most notably, David served as Vice President and General Manager at Bed Bath & Beyond, where he spearheaded all Merchant activities of the consumable businesses.

This extensive responsibility included leading all buying and merchandising efforts for Harmon Stores following its acquisition in the early 2000s.

More recently, David founded B2C Advisors, a successful management and retail consulting firm dedicated to guiding retailers and CPG companies through a range of strategic and tactical opportunities.

This deep and diverse background uniquely positions David to drive growth and maximize value for Harmon Stores and its investors.

Randy Madison

Operations Lead

Randy Madison has been instrumental in Harmon’s resurgence, having filled increasingly senior roles within the organization...

including Chief Merchandise Manager and District Manager—before stepping into his current position in January 2024. His deep institutional knowledge and leadership drive have been fundamental to Harmon’s transformation.

He recently led the operations of Harmon’s third post-relaunch location in Bridgewater, NJ, bringing the project from store build-out to grand opening with a transformed atmosphere—earning accolades from local teams and thrilled customers. Randy’s approach balances logistical precision with people-focused leadership, making culture-building and community engagement central to his success.

A self-described “servant leader,” Randy is known for fostering high-performance teams, solving complex retail challenges, and maintaining a customer-first mindset. His merchandising acumen ensures that each store delivers on Harmon’s promise of curated value.

Frequently Asked Questions

ABOUT THE HARMON RETAIL HOLDINGS INC (“HARMON”) SERIES A CONVERTIBLE [7% ] PREFERRED STOCK OFFERING

Offering Details

1. What kind of stock is Harmon (the “Company”) offering?

Shares of Series A Convertible Preferred Stock (the “Preferred Shares”).

2. What is the purchase price?

$1.00 per Preferred Share.

3. What is the minimum investment amount?

$2,500 for one Preferred Share.

4. What is the maximum amount that the Company is expecting to raise?

Up to $3 million. However, the Company is not required to sell any specific number or dollar amount of Preferred Shares in this private offering. As such, the Company may sell less than the maximum number of Preferred Shares offered, and the Company may receive less than the maximum amount of proceeds referenced above.

5. What are you using the funds raised for?

Harmon intends to use proceeds to expand their overall store count. For this, they will invest in inventory, store operations, opening expenses, and marketing. The company will also invest in online and further expanding this channel. Lastly, the company will use the proceeds for overall working capital needs.

6. Is this a Public Offering?

No, it is not. This is a private offering open to Accredited Investors. Harmon is planning later this year or in early 2026 to consummate a public offering pursuant to Regulation A (“Public Offering”) to allow retail investors to become shareholders.

7. Can I still purchase Public Offering shares?

Yes, if the Public Offering that the Company intends to pursue is approved by the U.S. Securities and Exchange Commission (the “SEC”), both existing shareholders and new investors will be eligible to participate in the Public Offering.

8. Do the Preferred Shares carry a dividend?

Yes, the Preferred Shares will carry an annual dividend payment of 7% of the price per share. The dividend on each Preferred Share shall accrue annually, beginning from the date of the issuance of such Preferred Share, until the conversion of the Preferred Share into shares of common stock of the Company. Upon the conversion of the Preferred Shares to shares of common stock of the Company, accrued and unpaid divided will be added to the liquidation preference of the Preferred Shares and be converted into shares of the Company’s common stock. Dividends will be payable (entirely or partially) in cash when, as, and if declared by Harmon’s board of directors (in its sole discretion). In the event that a Liquidity Event (as defined in the Preferred Shares Certificate of Designation), conversion or sale occurs prior to the end of a year, no portion of dividends will be paid with respect to such partial year. At the time of the issuance of the Preferred Shares, the Preferred Shares will be senior preferred equity of the Company and contain customary provisions restricting the payment of dividends on junior equity prior to the payment in full of the accrued and unpaid dividends on the Preferred Shares.

9. How does the conversion of Preferred Shares work?

The Preferred Shares will be convertible into shares of Common Stock of the Company (the “Common Stock”), in accordance with the terms and subject to the conditions set forth in the Certificate of Designation for the Preferred Shares.

Optional Conversion: Each Preferred Share (and any fractional Preferred Share) shall be convertible at any time at the option of the holder thereof into the number of fully paid and nonassessable shares of Class B Common Stock equal to the quotient of (x) the Liquidation Preference of such Preferred Share plus any accrued but unpaid dividends payable on such Preferred Share divided by (y) the Conversion Price as of the time of the conversion.

Mandatory Conversion: To the extent not previously converted, the Preferred Shares will automatically convert into shares of Common Stock upon (w) the closing of an initial public offering of common shares by the Company (including through a Regulation A offering), (x) the election by written consent of the holders of at least a majority of the outstanding Preferred Shares, (y) the closing of a Qualified Financing (as defined below), or (z) the closing of a Qualified Sale (as defined below), in each case, into the number of fully paid and nonassessable shares of

Common Stock equal to the quotient of (i) the Liquidation Preference of such Preferred Share being converted plus any accrued but unpaid dividends payable on such Preferred Share divided by (ii) the Conversion Price as of the time of the conversion.

The “Conversion Price” of a Preferred Share shall equal $1.00;

“Qualified Financing” means a round of equity financing consummated by the Company after this private offering in which the Company receives aggregate gross proceeds equal to $10,000,000 or more.

“Qualified Sale” means any Liquidity Event (as defined in the Certificate of Designation) in which the Company elects to require the mandatory conversion of the Preferred Shares; provided that such conversion will not be used to lower the amount of consideration such holder would have been entitled to receive in the Liquidity Event if a conversion of the Preferred Shares was not mandated by the Company in connection with such Liquidity Event.

How to Participate

10. If I make an investment, is it publicly disclosed?

No. As a private company, the Company intends to keep information related to its investors and their respective investments private and confidential.

11. How can I participate in this private offering?

To participate in this private offering, you will need to review the offering materials, including the Private Placement Memorandum, and complete the subscription documents, which are available at the following link www.harmoninvest.com. You will need to provide copies of personal identification (such as your driver’s license or passport) and verification of residence (such as a utility bill) for KYC and AML (know your customer & anti-money laundering) compliance purposes. You will also need to provide proof that you are an Accredited Investor (see FAQ item #15 below).

12. How do I pay for the Preferred Shares?

When you complete the subscription documents, you will be able to make payment to the escrow agent by credit card, wire transfer or ACH transfer. You may also mail a check to the escrow agent. Note that purchases by credit card can be made up to $100,000.

13. Are there higher fees if you invest via credit card, wire vs. ACH?

No, the costs are the same, regardless of how you invest. However, your bank may charge you outgoing wire fees.

14. Where am I sending funds to?

All funds are to be sent to our escrow agent, Wilmington Trust, and NOT to the Company. If you are making payment by wire transfer, funds should be wired to:

Wilmington Trust Company

ABA #: 031100092

A/C #: 178988-000

A/C Name: Harmon Escrow

Attn: Please put your name here

International Wires:

M&T

Buffalo, New York

ABA: 022000046

SWIFT: MANTUS33

Beneficiary Bank: Wilmington Trust

Beneficiary ABA: 031100092

A/C #: 178988-000

A/C Name: Harmon Escrow

Wires and ACH are preferred but if you plan to pay by check, mail your check to the following address:

Harmon Escrow

c/o Wilmington Trust

1100 North Market Street

Wilmington, DE 19890

Attn: Workflow Management

15. What is an accredited investor & do I have to be one to participate?

To purchase Preferred Shares in this private offering you must be an accredited investor as defined in Rule 501 promulgated under the Securities Act of 1933. Generally, the term “accredited investor” refers to any person or entity who satisfy the requirements set forth in Rule 501 and

who the Company takes reasonable steps to verify comes within any of the following categories, at the time of the sale of the Preferred Shares to such investor. For example, the following requirements apply with respect to an individual investor:

(i) Any natural person whose individual net worth or joint net worth with that person’s spouse, at the time of purchase, exceeds USD $1,000,000 (including spouse’s net worth and fair market value of the person’s home furnishings and automobiles, but excluding from the calculation the value of the person’s primary residence and the related amount of any indebtedness on primary residence up to the fair market value of the primary residence (any indebtedness that exceeds the fair market value of the primary residence must be deducted from the person’s net worth)); or

(ii) Any natural person who had an individual income in excess of USD$200,000 in each of the two (2) most recent years or joint income with that person’s spouse in excess of USD$300,000 in each of those years and has a reasonable expectation of reaching the same income in the current year;

16. How do I provide verification that I am an accredited investor?

You may wish to visit the SEC website to learn more, and view the Accredited Investor Information provided therein1. Listed below are three (3) ways for you to get verified as an accredited investor.

Note that income verification is valid for 12 months from the date we confirm it, while net worth verification is only valid for 3 months from the date we confirm it. Unverified investors will not be permitted to participate in this private offering.

Three Ways to Get Verified as an Accredited Investor:

1. Please have your CPA, attorney, registered investment advisor, or broker-dealer email us a letter on their letterhead, using this template (the pro-letter document which you will find when you fill out the subscription process online), attesting to your status as an accredited investor based upon their knowledge of your income or your net worth. This letter must be dated within the prior 60 days.

2. You may instead send income verification documents (such as IRS Forms 1040 or W-2) for us to review that evidence your income for the prior two years. All such information is kept strictly confidential.

3. You may instead send asset verification documents (such as bank or brokerage statements dated within the past 60 days), which we will review. If you use this method we will request a credit report from a national credit reporting agency to verify your debt, obtain a letter from you verifying that no debt exists other than what appears on the credit report, and calculate your estimated net worth to assist us in making a determination.

17. I’m not an accredited investor. What is available to me to purchase?

Investors who are not accredited will not have the opportunity to invest in Harmon’s private offering of Preferred Shares. You may sign up and be on our alert list for any future offerings including a potential public offering. Sign up to be notified of future Harmon offerings by clicking here.

Returns, Trading & Risks

18. How do I get a return on my investment?

Investing in private companies is risky and there is no guarantee you will get a return on your investment or that you may be able to sell the Preferred Shares. However, an “exit” event could opens up the opportunity where you could convert your shares into cash or more liquid assets. “Exits” include going public or getting acquired by another company or a financial investor. If the value of the Company grows, then could have a higher potential of making a profit on your investment in the Preferred Shares in connection with a potential exit event. No public market currently exists for the Preferred Shares (or the common shares into which the Preferred Shares may be converted).

19. What are the risks of investing in Harmon?

Any investment in the Preferred Shares involves a high degree of risk. You should consider carefully the risk factors information, together with the other information contained in the Company’s Private Placement Memorandum, before you decide to buy any Preferred Shares.

20. When will I receive my Preferred Shares?

Preferred Shares that you purchase will be held in your name, in electronic form at the transfer agent for this private offering. No stock certificates will be sent to you, but you will receive a Welcome Letter directly from the Company’s transfer agent with information on how to access and manage your account within 30 days after the Company accepts your proposed investment in Preferred Shares.

21. What is a transfer agent?

Generally, a transfer agent maintains a record of ownership, including contact information, of an issuer’s registered stockholders.

22. Who is Harmon’s transfer agent for this private offering?

The transfer agent for this private offering is Equity Stock Transfer. All investors will receive a Welcome Letter directly from Equity Stock Transfer with information on how to access and manage their accounts within 30 days after the Company accepts your proposed investment.

23. How do I trade my stock?

There is currently no public trading market for the Preferred Shares or the common shares into which the Preferred Shares may be converted, and there can be no assurance that any such public market will develop in the foreseeable future, if at all. This private offering relies upon exemptions from the registration requirements of federal and state securities laws. Those exemptions require that the securities be purchased for investment purposes only, and not with a current view toward their distribution or resale. Unless the Preferred Shares, or the common shares into which the Preferred Shares may be converted, are subsequently registered or qualified with the SEC and any required state securities authorities, or appropriate exemptions from registration are available, you may be unable to liquidate your investment in the Company even if your financial condition makes such liquidation necessary. Accordingly, prospective investors who require liquidity in their investments should not invest in the Preferred Shares. An investment in the Preferred Shares should only be made by those who can afford the loss of their entire investment. The Company my conduct a Public Offering within 24 months of final closing of this offering.

If the Company consummates the Public Offering, then we intend to apply to have certain of shares of our common stock listed on either NASDAQ or the NYSE (if on NASDAQ,). However, the listing of our common stock on the NASDAQ or NYSE is not a condition of our proceeding with this private offering, and no assurance can be given that our application to list will be approved or that an active trading market for our common stock will develop. If shares of our common stock is listed on NASDAQ or NYSE, you will be able to deposit any shares you purchased with a broker. Until you deposit your shares in a brokerage account, the transfer agent will maintain the record of your ownership. Once you deposit your shares with a broker, the broker will maintain that record.*

24. Will shares I purchase in this private offering be tradeable after the company goes public?

At the closing of the company’s anticipated public offering, the company will convert all shares sold in this private offering (Series A 7% Preferred Offering) to common shares. To the extent such common shares are not tradeable after a statutory holding period, Newsmax intends to file a registration statement with the Securities and Exchange Commission that will seek to register these common shares, subject to approval by the Commission, that will allow them to be traded on a public exchange.

25. How do I get additional information on the offering?

For additional detailed information we encourage you to read the Private Placement Memorandum in its entirety. If you have additional questions you can email our investment banker at harmon@digitaloffering.com and a representative will be in touch with you. Please be sure to include your best daytime phone number and other contact information.

*No public market currently exists for the securities of Harmon, and if a public market develops following the offering, it may not continue. Please read the Company’s Private Placement Memorandum in its entirety for additional information on the company and risk factors related to the offering.

INVEST NOW

Harmon Retail Holdings, LLC (the “Company” or “Harmon”), is currently undertaking a private placement offering pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or Rule 506(c) of Regulation D promulgated thereunder. Investors should consider the investment objectives, risks, and investment time horizon of the Company carefully before investing. The private placement memorandum relating to this offering of equity interests by the Company will contain this and other information concerning the Company and the securities referenced in this document, including risk factors, which should be read carefully before investing. You should be aware that (i) the securities may be sold only to “accredited investors,” as defined in Rule 501 of Regulation D; (ii) the securities will only be offered in reliance on an exemption from the registration requirements of the Securities Act and will not be required to comply with specific disclosure requirements that apply to registration under the Securities Act; (iii) the United States Securities and Exchange Commission will not pass upon the merits of or give its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials; (iv) the securities will be subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities; investing in these securities involves a high degree of risk, and investors should be able to bear the loss of their entire investment. Furthermore, investors must understand that such investment could be illiquid for an indefinite period of time.

The offering documents may include “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions for forward looking statements. This information is supplied from sources we believe to be reliable but we cannot guarantee accuracy. Although we believe our expectations expressed in such forward-looking statements are reasonable, we cannot assure you that they will be realized. Investors are cautioned that such forward-looking statements involve risks and uncertainties, including, but not limited to the risks and uncertainties set forth in the attached materials, which could cause actual results to differ materially from the anticipated results set forth in such forward-looking statements. Any forward-looking statement made by us speaks only as of the date on which it is made, and we undertake no obligation to publicly update any forward-looking statement except as may be required by law.

The Company is "Testing the Waters" under Regulation A under the Securities Act of 1933. The Company is not under any obligation to make an offering under Regulation A. No money or other consideration is being solicited in connection with the information provided, and if sent in response, will not be accepted. No offer to buy the securities can be accepted and no part of the purchase price can be received until an offering statement on Form 1-A has been filed and until the offering statement is qualified pursuant to Regulation A of the Securities Act of 1933, as amended, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of its acceptance given after the qualification date. Any person's indication of interest involves no obligation or commitment of any kind. The information in that offering statement will be more complete than the information the Company is providing now, and could differ materially. You must read the documents filed. No offer to sell the securities or solicitation of an offer to buy the securities is being made in any state where such offer or sale is not permitted under the "blue sky" or securities laws thereof. No offering is being made to individual investors in any state unless and until the offering has been registered in that state or an exemption from registration exists therein.

The securities offered using Regulation A are highly speculative and involve significant risks. The investment is suitable only for persons who can afford to lose their entire investment. Furthermore, investors must understand that such investment could be illiquid for an indefinite period of time. No public market currently exists for the securities, and if a public market develops following the offering, it may not continue.